This is due to the cost of inventory includes all costs necessary to acquire the inventory and the freight-in cost falls into this category as the freight is necessary for the goods to be delivered to the company as a buyer. On the other hand, the company needs to record the freight-in cost as a part of the cost of the inventory purchased under the perpetual inventory system. After all, under the periodic inventory system, the inventory account and cost of goods sold account will only be updated when the company performs the physical count of the inventory (usually at the end of the period). Journal entry for freight-in under the periodic inventory system is a bit easier as the company just needs to record this cost in the freight-in account or transportation cost account as the net cost of purchases. Likewise, the company needs to make journal entry for freight-in by recognizing this cost as a part of merchandise inventory if it uses the perpetual inventory system or recognizing it as a part of net cost of purchases if the company uses the periodic inventory system. The periodic system can also work well when the warehouse staff is poorly trained in the uses of a perpetual inventory system, since they might inadvertently record inventory transactions incorrectly in a perpetual system.Freight-in cost incurs when the company as the buyer needs to pay for the transportation of goods that it purchases from the suppliers. The primary case where a periodic system might make sense is when the amount of inventory is very small, and where you can visually review it without any particular need for more detailed inventory records.

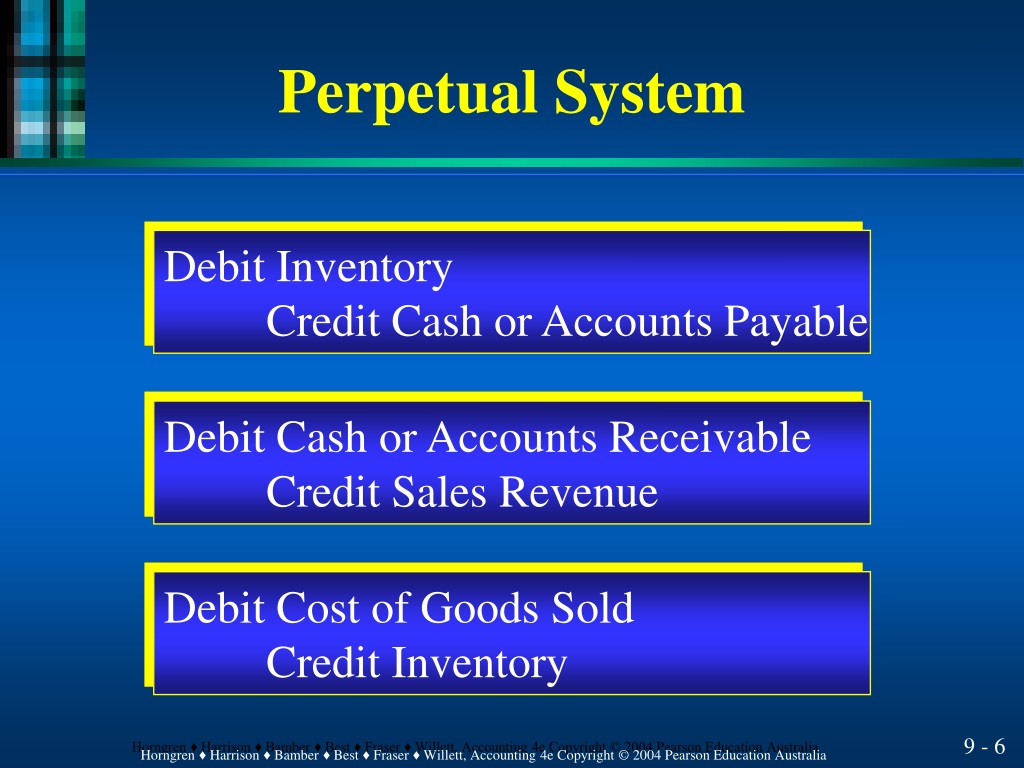

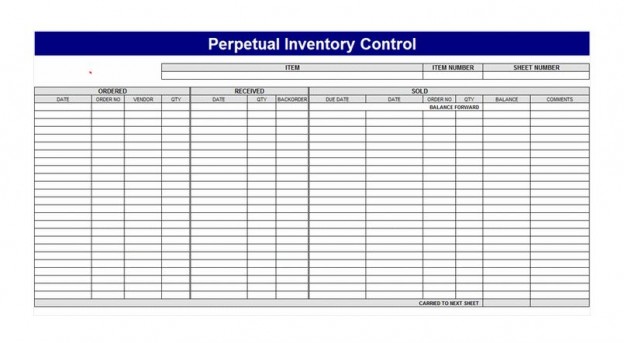

This list makes it clear that the perpetual inventory system is vastly superior to the periodic inventory system. Conversely, such investigations are much easier in a perpetual inventory system, where all transactions are available in detail at the individual unit level. It is nearly impossible to track through the accounting records under a periodic inventory system to determine why an inventory-related error of any kind occurred, since the information is aggregated at a very high level. Conversely, under a periodic inventory system, all purchases are recorded into a purchases asset account, and there are no individual inventory records to which any unit-count information could be added. Under the perpetual system, inventory purchases are recorded in either the raw materials inventory account or merchandise account (depending on the nature of the purchase), while there is also a unit-count entry into the individual record that is kept for each inventory item. It is impossible to use cycle counting under a periodic inventory system, since there is no way to obtain accurate inventory counts in real time (which are used as a baseline for cycle counts). In the latter case, this means it can be difficult to obtain a precise cost of goods sold figure prior to the end of the accounting period.Ĭycle counting. Conversely, under the periodic inventory system, the cost of goods sold is calculated in a lump sum at the end of the accounting period, by adding total purchases to the beginning inventory and subtracting ending inventory. Under the perpetual system, there are continual updates to the cost of goods sold account as each sale is made.

#Under a perpetual inventory system manual

Conversely, the simplicity of a periodic inventory system allows for the use of manual record keeping for very small inventories.Ĭost of goods sold. It is impossible to manually maintain the records for a perpetual inventory system, since there may be thousands of transactions at the unit level in every accounting period.

Conversely, under a periodic inventory system, there is no cost of goods sold account entry at all in an accounting period until such time as there is a physical count, which is then used to derive the cost of goods sold.Ĭomputer systems. Under the perpetual system, there are continual updates to either the general ledger or inventory ledger as inventory-related transactions occur. There are a number of other differences between the two systems, which are as follows:Īccounts. Comparing Periodic and Perpetual Inventory Systems The periodic system relies upon an occasional physical count of the inventory to determine the ending inventory balance and the cost of goods sold, while the perpetual system keeps continual track of inventory balances. The more sophisticated of the two is the perpetual system, but it requires much more record keeping to maintain. The periodic and perpetual inventory systems are different methods used to track the quantity of goods on hand.

0 kommentar(er)

0 kommentar(er)